Revolving Credit Facilities Calculator

Try our revolving credit facility calculator below to find out how much you can borrow to take your business to the next level.

Try our revolving credit facility calculator

Find out how much you can borrow to take your business to the next level.

Calculations are indicative only and intended as a guide only. The figures calculated are not a statement of the actual repayments that will be charged on any actual loan and do not constitute a loan offer.

Monthly payments

-

Monthly interest

-

Total interest

-

Length of loan

-

Total cost of loan

-

If you are satisfied with your results, you can proceed here

Revolving Credit Facilities Calculator

A revolving credit facility is a type of credit that provides borrowers with a set amount of capital that can be accessed as needed, repaid, and borrowed again. It's akin to a credit card but is typically used by businesses to manage cash flow, cover operational costs, or invest in growth opportunities. This financial instrument is crucial for companies needing flexibility in their borrowing. Let’s look into the mechanics of revolving credit facilities and understand how to calculate their usage, costs, and benefits using a revolving credit facility calculator.

Using a Revolving Credit Facility Calculator

A revolving credit facility calculator typically requires inputs such as the credit limit, drawn amount, annual interest rate, and applicable fees. The calculator automates the computations and provides an assessment of the cost and available credit.

Importance of Regular Monitoring

Regular monitoring of the RCF usage is vital to ensure that the business stays within its borrowing limits and manages its interest and fee costs effectively. Businesses should frequently review their credit facility statements and use calculators to forecast future costs based on expected usage.

Advantages of Using a Revolving Credit Facility Calculator

1. Informed Decision-Making: by providing a clear breakdown of costs and net funding, the calculator helps businesses make informed decisions about whether invoice finance is a suitable option.

2. Financial Planning: businesses can better plan their finances, knowing how much cash flow they can expect to receive and when.

3. Cost Comparison: the calculator allows businesses to compare different financing options and providers, ensuring they select the most cost-effective solution.

4. Time Efficiency: calculating potential costs and benefits manually can be time-consuming and prone to error. A calculator streamlines this process, providing quick estimates less likely to fall into miscalculations.

A revolving credit facility is a powerful tool for businesses that need flexible access to capital. Understanding how to calculate the costs associated with an RCF is crucial for effective financial management. By using a revolving credit facility calculator, businesses can simplify these calculations, ensuring accuracy and efficiency in managing their credit lines. Regular monitoring and strategic use of the facility can help businesses optimise their cash flow, manage operational costs, and invest in growth opportunities without the constant need for new loan applications.

In summary, whether you're a financial manager or a business owner, getting the use of a revolving credit facility and its calculations can provide significant advantages in maintaining financial stability and leveraging growth opportunities.

Please note that the information above is not intended to be financial advice. You should seek independent financial advice before making any decisions about your financial future.

Calculations are indicative only and intended as a guide only. The figures calculated are not a statement of the actual repayments that will be charged on any actual loan. Tide will not be responsible for any discrepancy in the loan calculations and does not accept any liability for loss, which may be attributable to the reliance on and use of this calculator.

It’s important to remember that all loans and credit agreements come with risks. These risks include non-payment and late-payment of the agreed repayment plan, which could affect your business credit score and impact your ability to find future funding. Always read the terms and conditions of every loan or credit agreement before you proceed. Contact us for support if you ever face difficulties making your repayments.

Funding Options, now part of Tide, helps UK firms access business finance, working directly with businesses and their trusted advisors. Funding Options are a credit broker and do not provide loans directly. All finance and quotes are subject to status and income. Applicants must be aged 18 and over and terms and conditions apply. Guarantees and Indemnities may be required. Funding Options can introduce applicants to a number of providers based on the applicants' circumstances and creditworthiness. Funding Options will receive a commission or finder’s fee for effecting such finance introductions.

We're here to help

Find the right Funding Options without affecting your credit score by filling out our quick and easy form.

How does it work?

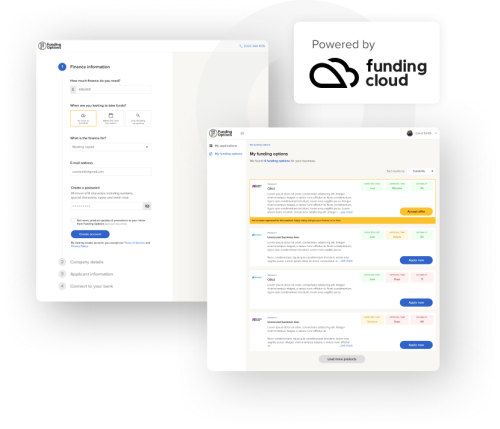

We break down funding barriers with a simple application process that empowers you. Our technology, Funding Cloud, accurately validates your business profile, matching you to the industry’s largest lender network. Funding results are uniquely tailored to each and every business.

Tell us how much you need

Tell us how much you need to borrow, what it's for and provide some basic information about your business.

Get an instant comparison

Our smart technology will compare up to 120+ lenders and match you with the right finance options for your needs.

Apply and get your funding

We'll help you through the process from application to receiving your funds.