News

Adapt to Survive – how businesses have pivoted to stay afloat during COVID-19

6 Aug 2020

The challenge of the coronavirus pandemic should not be underestimated. UK job losses as a result of the COVID-19 lockdown and the changing economic climate have reached 650,000 in Mid-July – and that’s before the winding up of the furlough scheme in October when employers will have to contribute to the wages of their furloughed staff.

- Well-established businesses that have pivoted due to COVID-19

- The challenge for smaller businesses and freelancers

- How additional finance is helping businesses to pivot

- Was recent funding planned or essential for British firms?

- Areas where funding has been in most demand during the COVID-19 crisis

- The industries best suited to pivoting during the coronavirus crisis

Economic analyst Andrew Wishart of Capital Economics believes the fall in employment could reach 5% by October, which would be “twice the size of the fall in the global financial crisis” of 2008. With the country's army of businesses big and small bracing themselves for the aftershock of COVID-19, the lockdown has been viewed by some entrepreneurs as a chance to pivot and redefine their business models to tap into new income streams.

There is a saying in the world of business that entrepreneurs should “never waste a good crisis”. The most successful business leaders are those that embrace the disruption and uncertainty which removes us from all too comfortable patterns and habits of work. Recessions give businesses a chance to be creative and adopt a “what if” mindset. There will be businesses that worry about what might happen, but there are others who will channel that negative energy into what they can do about their situation by pivoting.

Well-established businesses that have pivoted due to COVID-19

Already, there are impressive examples of businesses across the UK taking the decision to evolve and redesign their products or services to meet new consumer demands.

My VIP Card is a loyalty card discount program offering more than 4,500 discounts with retailers at a local and national level to consumers. It offers cashback on purchases with selected high-street retailers and even dining out at certain restaurants. The business launched a brand new Key Worker Card, designed to donate 30% of its membership costs directly to the NHS during this crisis whilst helping those on the frontline to save between £40-£100 a month on average. It’s not only a positive ethical story; it has strong PR benefits for the My VIP Card brand too.

KwizzBit has become one of the leading interactive smartphone pub quiz brands, delivering fully customisable quiz software for pubs, businesses, charities and even home use among family and friends. It was an idea roundly rejected on the BBC’s Dragons’ Den that has nevertheless gone on to prove the likes of Peter Jones and Deborah Meaden very wrong. The company’s virtual services have proven particularly popular during lockdown, with businesses embracing the KwizzBit software to run quizzes among employees in a bid to foster interactivity and boost team morale in these unprecedented times.

On a more serious note, EveryLIFE Technologies, which specialises in real-time monitoring of care management, developed and released a free app designed to enable care homes and care providers to better monitor the COVID statuses in local areas and related metrics, not to mention vital personal protection equipment (PPE) stock levels. This innovation has made a human difference, helping to protect frontline carers and society’s most vulnerable.

The challenge for smaller businesses and freelancers

In 2019, the UK boasted as many as 5.8 million small businesses, representing 99.9% of the nationwide economy. Despite being the lifeblood of the UK, the vast majority of small firms exist on much smaller margins than their well-established counterparts. Furthermore, their lack of resources can make it harder to handle peaks and troughs in cash flow and invest in pivot strategies.

The sudden nature of the COVID-19 lockdown has meant that many small businesses and independents have not only had to grapple with the consequences of their physical units being out of bounds, but they’ve also had to ascertain whether it’s conceivable to find new ways of working and serving their valued customers.

Many small firms have embraced the digital world as a result. In fact, smaller companies can be more digitally agile than larger businesses that aren’t hamstrung by legacy technology infrastructure.

Childs Farm is a business specialising in toiletries and cosmetics, focusing specifically at the children’s sensitive skin market. By 2017, founder, Joanna Jensen was shifting £12m worth of stock per annum, thanks to her affordable products that ease eczema symptoms. In the months prior to the COVID-19 lockdown, Childs Farm appointed a new CEO with digital-first expertise, enabling the brand to become “as digitally fit as possible” in the words of Ms Jensen. Consequently, the brand invested heavily in its e-commerce so that it was in the best shape possible to “ramp up its bricks-to-clicks sales" when the pandemic hit.

Patricia Hammond is a professional classical musician. Within seven days, her full-time income went from 100% to zero. But then, like many in the entertainment industry, she pivoted her services to the virtual space, transforming her YouTube channel into her primary shop window. She pivoted to perform paid-for song requests for her growing user base online. Despite funding being available, Patricia said she felt “ashamed” to claim funding, but she does think the last quarter has helped her to become more versatile and adaptable.

The events and travel industries have been hit hardest by the coronavirus crisis, with no end in sight for the uncertainty in these sectors. Opulent Travel Lounge was an online agency committed to helping travellers find their perfect package holidays and flight deals. Prior to the COVID-19 pandemic, 2020 was due to be their best year yet, with a projected turnover of £1.2m.

Given the overnight drop-off of holidays and flights due to the near-global lockdown, the Opulent brand pivoted to explore alternative avenues in travel and tourism. Opulent Beach Club was launched, identifying an opportunity in the global fitness and beachwear market to provide the latest fashion trends via a new e-commerce store. This store has helped plug the revenue gap and has helped the Opulent Travel brand evolve to move closer to the fully integrated luxury travel shop that the owner envisaged. As Opulent Beach Club was a new venture, no funding was available to help the agency pivot, having to rely solely on savings to rebuild.

How additional finance is helping businesses to pivot

The British Business Bank has been overseeing the launch of the Bounce Back Loan Scheme (BBLS) and the Coronavirus Business Interruption Loan Scheme (CBILS), providing emergency finance to small businesses of all shapes and sizes to not only keep their firms running but to hopefully pivot and stay relevant to consumers’ needs.

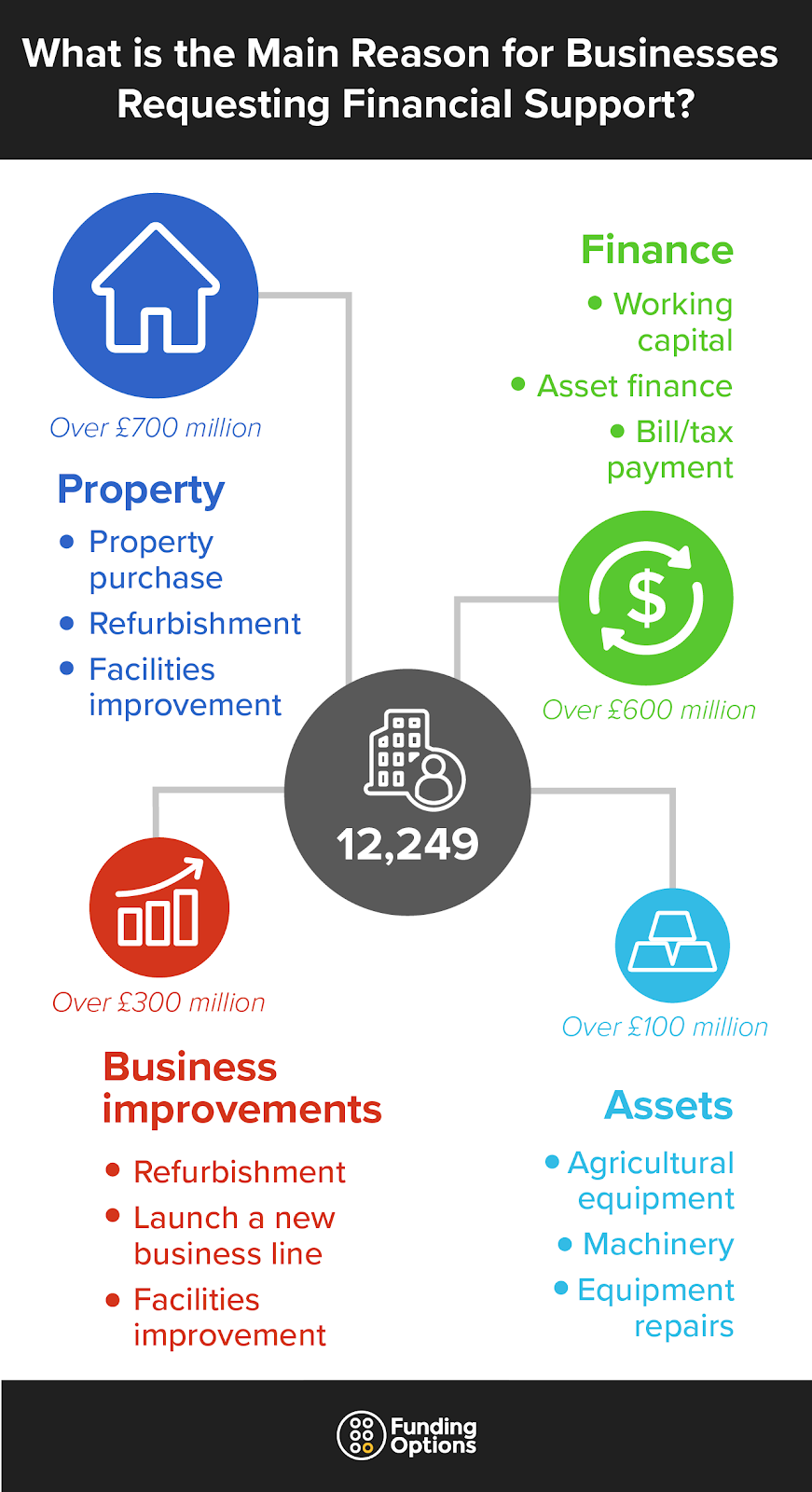

Funding Options was selected by the British Business Bank to help many of these small businesses get access to the funds they need, with over 200 lenders ready and waiting to help them to get through this challenging period. Approximately £4.03bn of emergency funding has been requested by businesses via Funding Options in the last four months.

Of this overall £4.03bn, 2.7% was requested by businesses looking to launch new business lines, while an additional 1.5% was requested to aid the expansion of existing businesses despite the ongoing uncertainty of COVID-19.

For a case in point, James Auctioneers has become one of the leading modern auction houses in the last decade, specialising in high-end watches, memorabilia, as well as rare and unusual collectables. With the prospect of physical auctions disappearing overnight following the announcement of lockdown, they switched their attentions towards online auctions. They obtained £15,000 of funding through Funding Options to act as cash flow to purchase stock and turn over a profit during their inaugural online auctions, which have resulted in an increase in sales. It’s got to the point that they “probably won’t go back to physical auctions”, as they state – such is the way online sales have “revolutionised” their business model.

Was recent funding planned or essential for British firms?

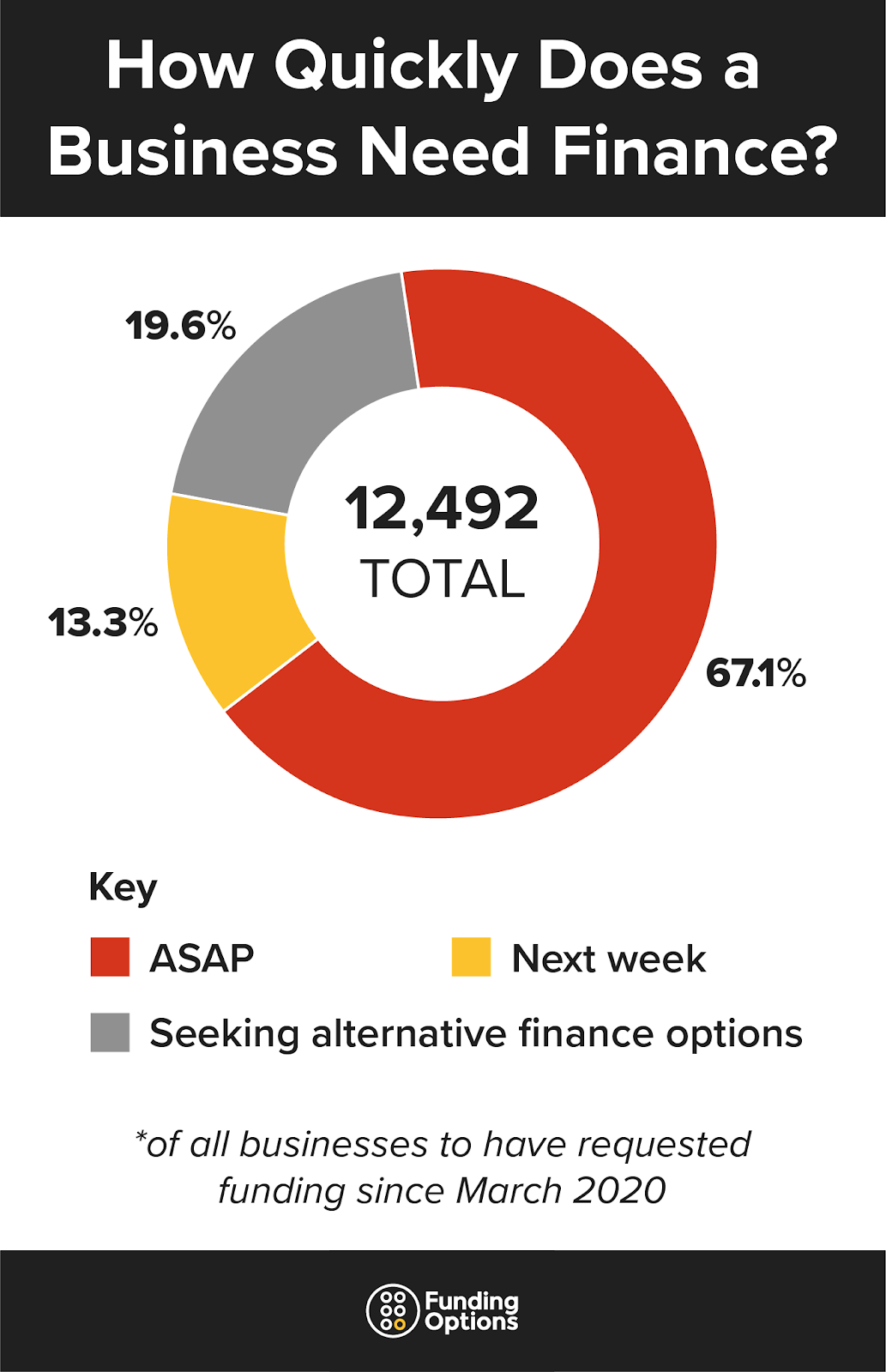

Of the £4.03bn requested via Funding Options to limited companies and sole traders since the start of the pandemic, just 13.3% of applicants required the funds within a matter of weeks. Over two-thirds (67%) needed the funds ASAP. The urgency with which most firms needed the finance suggests that for many, it served purely cash flow purposes instead of planned expansion.

It’s well worth noting the “excluded millions” of businesses that pay themselves via company dividends and have subsequently missed out on the UK government’s emergency bailout schemes. For instance, award-winning bridal brand Motasem, which sells gowns designed by Sabina Motasem, was ineligible for any of the rescue packages. Without funding, businesses like Motasem have had to become even more creative and innovative to reduce overheads and continue to find ways of serving people’s needs.

Aside from the brand’s new all-vegan, fully sustainable range of wedding dresses, Motasem has also become a zero-waste business by repurposing all off-cuts into DIY craft kits for children and adults to make their own face masks for the post-lockdown era. Motasem believe that focusing on sustainability is a “far more effective way to plan for a better future” than any government intervention.

Areas where funding has been in most demand during the COVID-19 crisis

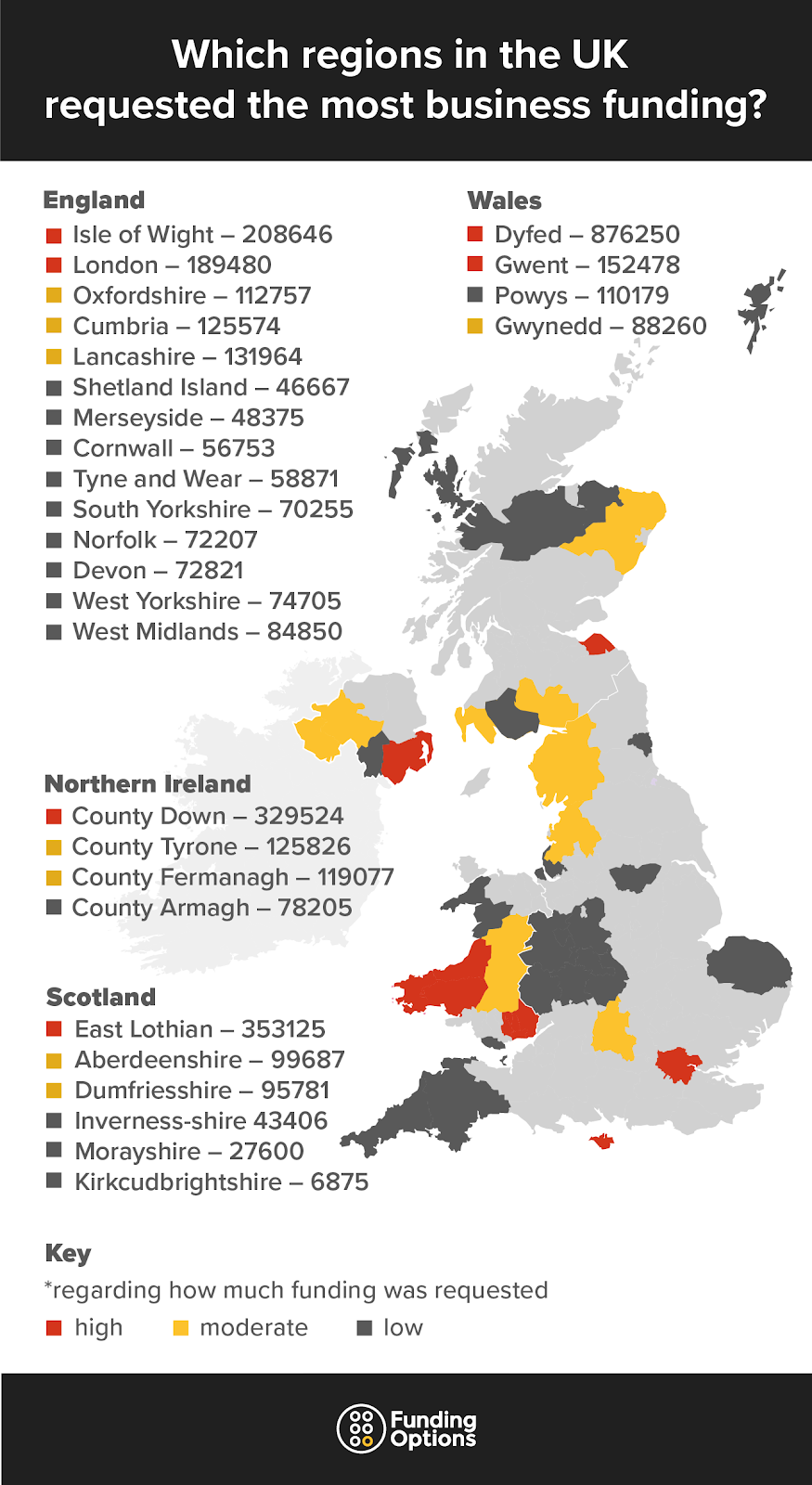

In total, 20,814 businesses have applied for emergency finance via Funding Options’ band of 200+ lenders. Almost 20% of all applications derived from the London region, as the capital’s economy suffers prolonged damage. The Centre for London think-tank estimates over a quarter (28%) of Londoners battled to “make ends meet” during the peak of the COVID-19 lockdown. The London Chamber of Commerce & Industry also claims that London will emerge “poorer as a city” post-coronavirus, which explains the spate of funding requests.

Other UK regions where funding has been in most demand via Funding Options during the COVID-19 crisis include:

Lancashire

Essex

West Midlands

Middlesex

Meanwhile, Q2 2020 data suggests Lancashire’s economy has also experienced an “extraordinary” collapse. The Quarterly Economic Survey from the Lancashire Chambers of Commerce said that many industries are experiencing declines far exceeding those seen at the peak of the 2008 Global Financial Crisis.

Babs Murphy, chief executive of the North and Western Lancashire Chamber, said: “The scale of the collapse is quite extraordinary. This also comes after a very weak set of figures in Q before the pandemic really got going.”

The industries best suited to pivoting during the coronavirus crisis

The reality is that some industries have been more adaptable than others to the changing face of business and society amid the COVID-19 pandemic.

Manufacturers and producers

Light industrial manufacturers, engineers and even food producers have been able to pivot their in-house operations in society’s hour of need. Iconic 21st-century brewers Brewdog and a string of gin distilleries have diversified their offering during the pandemic to produce much-needed hand sanitiser around-the-clock. Engineers have also adapted their machinery and automated processes to support the frontline efforts with new ventilators and oxygen supplies for COVID-19 wards.

Hardware and building supplies firms

Some industries have been gifted opportunities to take full advantage of the coronavirus lockdown. With households encouraged to stay at home and employees increasingly furloughed for several weeks, its little surprise that consumer demand for DIY goods has gone through the roof – a 42% rise in May.

Online food delivery platforms

With cafes and restaurants unable to welcome valued patrons through their doors, online food delivery platforms have benefitted hugely. They’ve provided a foundation for restaurants to continue to serve high-quality food and have it delivered to doorsteps throughout their local area. This has been a lifeline for caterers.

For any business looking for the right funding to pivot and take their operations in a different direction post-lockdown, Funding Options is there to help with free quotes – which won’t affect your credit score – and dedicated business finance specialists waiting to connect you with over 200 willing lenders.

Get startedSubscribe to our newsletter today

Sign up for the best of Funding Options sent straight to your inbox.