Education

How can small businesses help the UK economy?

5 May 2020

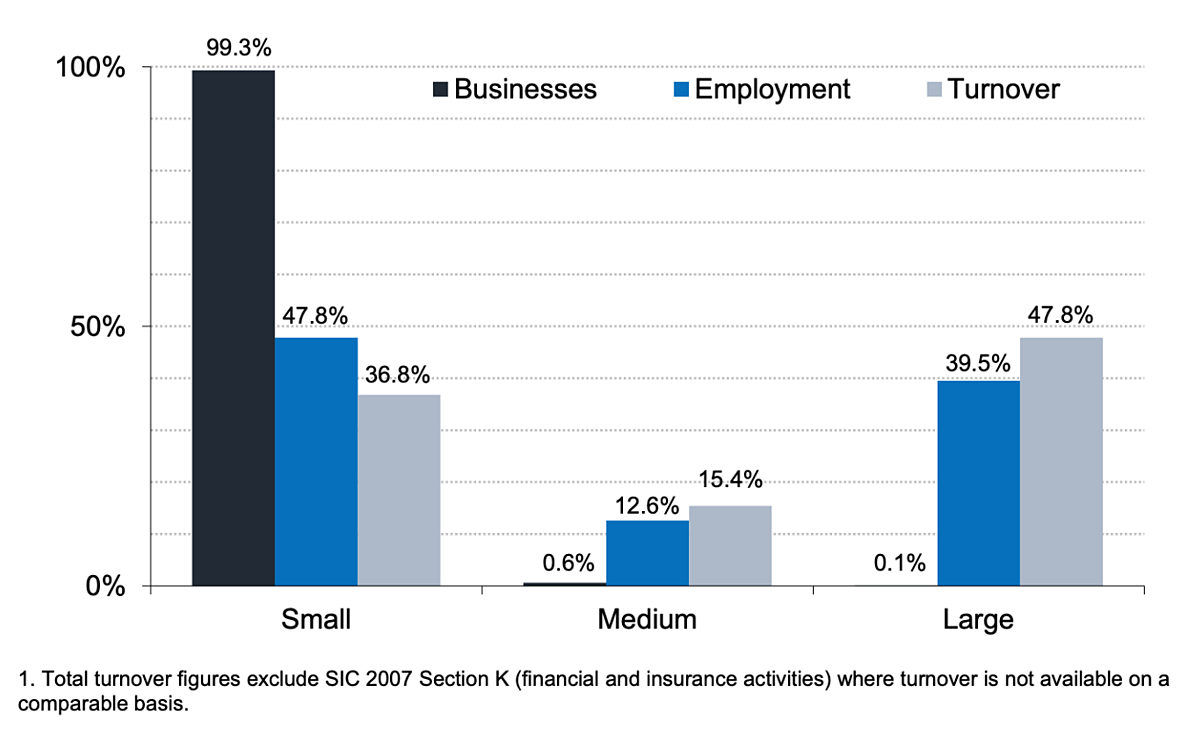

Small businesses are the lifeblood of the UK’s economy. You only have to peek at the figures to see why. There were 5.9 million SMEs (businesses with less than 250 employees) in the UK in 2019, accounting for more than 99% of all businesses. What’s more, SMEs make up three-fifths of the employment and around half of the turnover in the UK private sector, according to the Department for Business, Innovation & Skills.

The graph below shows the contribution of different sized businesses to total population, employment and turnover¹ at the start of 2019.

How can small businesses help the economy

Source: Department for Business, Energy & Industrial Strategy

Large businesses might dominate the FTSE100, but small businesses drive growth, create employment and encourage competition through innovation and disruption. The UK’s small business scene remained resilient even in the face of Brexit uncertainty, and it's crucial that they get the support they need throughout the COVID-19 pandemic.

381,000 new businesses were “born” in 2018, approximately the same as in 2017. The number of startups founded between 2013 and 2018 was significantly higher than in the five-year period before that. In 2018, there were 56% more business births than in 2000.

Conversely, 336,000 businesses folded in 2018 – 26,000 fewer than in the previous year. It was the steepest fall in the number of business closures since 2010 when the UK crept out of recession following the financial crisis of 2007-08.

Supporting local economies

It’s a fact: small businesses have the capacity to help local communities thrive.

As well as spurring on economic growth by providing employment opportunities to local people, they benefit larger national and international businesses who depend on them for various functions and services through outsourcing.

Successful small businesses also have the potential to drive up property value in their local area and contribute to the local authority through property tax. Local businesses tend to buy local too, and help foster connections within the community.

Promoting flexibility

One advantage small businesses have over large ones is their ability to be more agile therefore more resilient in the face of change. Large corporations can find themselves burdened with bureaucracy and tangled in red tape when it comes to things like employee working hours.

Employees in small businesses often feel more empowered because they have a higher level of autonomy over the decision making process. Having a sense of ownership over one’s work can work wonders for morale and help small business retain employees.

SMEs can utilise their adaptability by embracing flexible working. Offering people the option to work from home one or two days a week, condense their hours, work part-time or even choose their own working schedule is an extremely attractive proposition when you consider that 70% of employees want to work more flexibly in the future.

The same can be said for emerging trends and technologies. Without the burden of red tape, small businesses can adopt new practices a lot quicker than larger competitors. It’s a lot easier to get new products and services in front of customers and meet the changing expectations of the marketplace in order to remain competitive.

When does a small business become a big business?

A small business becomes a big business when it has a turnover of over £25.9m and over 250 employees. Some small business owners are happy to keep things small, whereas others have dreams of driving up profit margins and extending their business’ reach.

When it comes to growing a small business there’s no magic formula, but a handful of growth strategies have been used by a number of successful big business, including:

Expanding market reach

Finding a niche

Franchising

Diversifying products & services

Boosting cash flow

Reinvesting in the business

Orchestrating a merger or acquisition

Recently, the BBC published an article on five businesses that are thriving despite the lockdown. These include small businesses such as online crafts firm Stitch & Story as well as large brands like Netflix and Boohoo.

Subscribe to our newsletter today

Sign up for the best of Funding Options sent straight to your inbox.