Covid-19

The New Normal: The End of Covid-19 Restrictions

24 Feb 2022

Prime Minister Boris Johnson’s speech Monday outlined the U.K. government’s new long-term COVID-19 plan, with today marking the first step towards ‘living with covid’ as all remaining self-isolation requirements are lifted today.

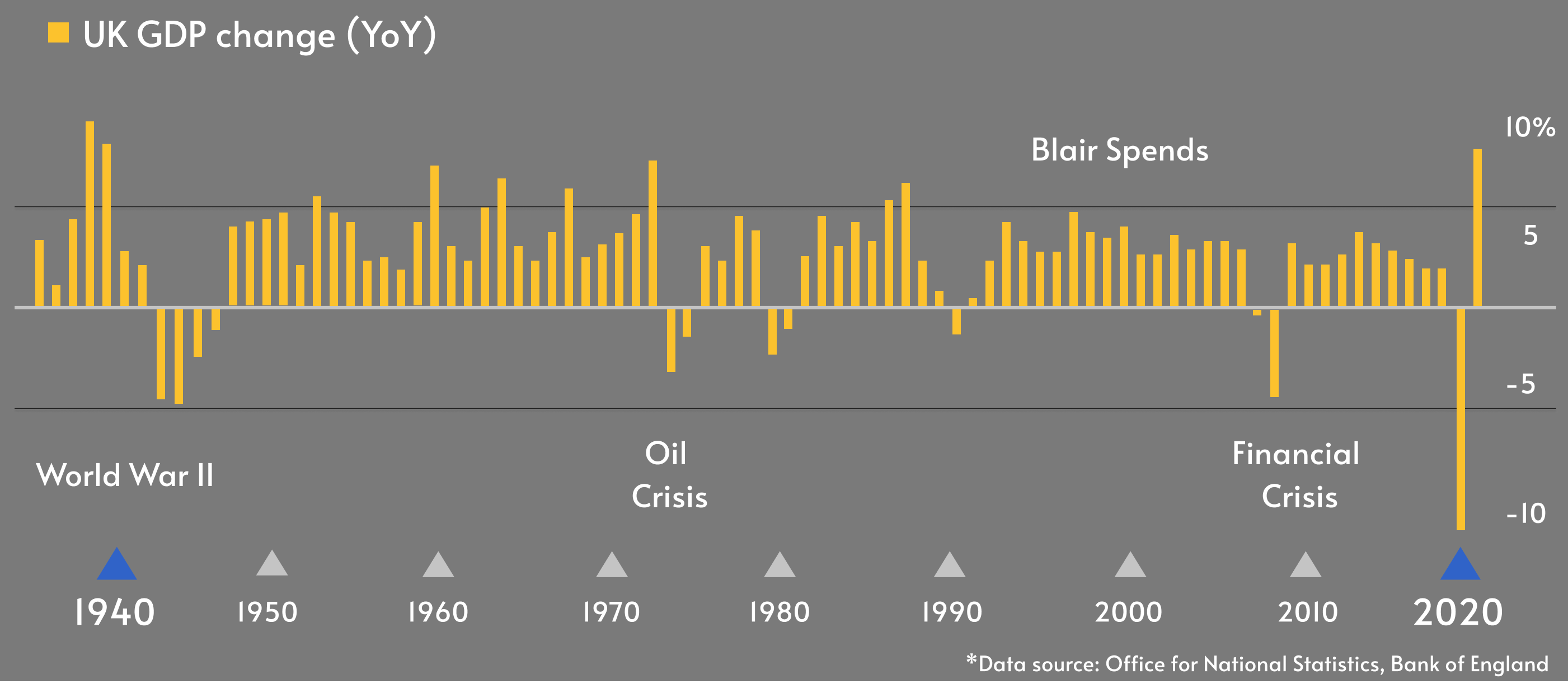

Despite suffering a harsher downturn than most, reaching an all time low of 9.4% in 2020, the United Kingdom has thoroughly bounced back, enjoying a resilient recovery aided by billions of pounds worth of support, such as the government's Recovery Loan Scheme, with the economy now forecast to once again outperform other G7 nations this year.

“Restrictions pose a heavy toll on our economy, our society, our mental wellbeing, and the life chances of our children.” The PM said in his statement ‘Living with COVID’ on 21 February.

The success of the RLS, CBILS and BBLS schemes were, as Chancellor of the Exchequer Rishi Sunak said recently in the commons a “package of support […] made at the right time,”. Announced in the Chancellor’s 2021 Budget, the RLS, introduced in October last year, is a follow-up to the CBILS and BBLS schemes (which ended on 31 March 2021) and is designed to help businesses manage cash flow, investment and growth post-lockdown. The RLS will end on 30th June 2022, however businesses still have a further three months to utilise the scheme, and can make applications right up until the end of the day on that date.

Apply for RLS fundingWhat does this mean for businesses?

Reports are already indicating a greater than average emphasis on expansionary strategies such as boosting capital expenditure, expanding into new markets and the launching of new products. Businesses, being the 'backbone' of industry, drive innovation and provide a critical source of jobs for economic growth. According to the House of Commons Library 2021 Tax Statistics, in 2019/20 public sector receipts were equivalent to 36.7% of the U.K's entire GDP, with receipts exceeding 36.5% of GDP in each year since the 2010/11 world financial crisis.

With these and other reports already indicating a greater than average emphasis on expansionary strategies, businesses might now look towards expanding into new markets and the launching of new products. Sectors such as hospitality, nightlife and entertainment could, by boosting capital expenditure this quarter, see a rise in consumer spending as restrictions continue to lift.

While the above-mentioned Recovery Loan Scheme can play a key role in accessing the necessary funding to continue driving growth, it is only one lending ecosystem options businesses can take advantage of. Now, for example, might be the opportune time to reassess business loans and negotiate better terms through asset refinancing, or perhaps minimising the overall impact of rising inflation through inventory or invoice financing? Try using our business loan calculator to find out how much you can borrow to take your business to the next level.

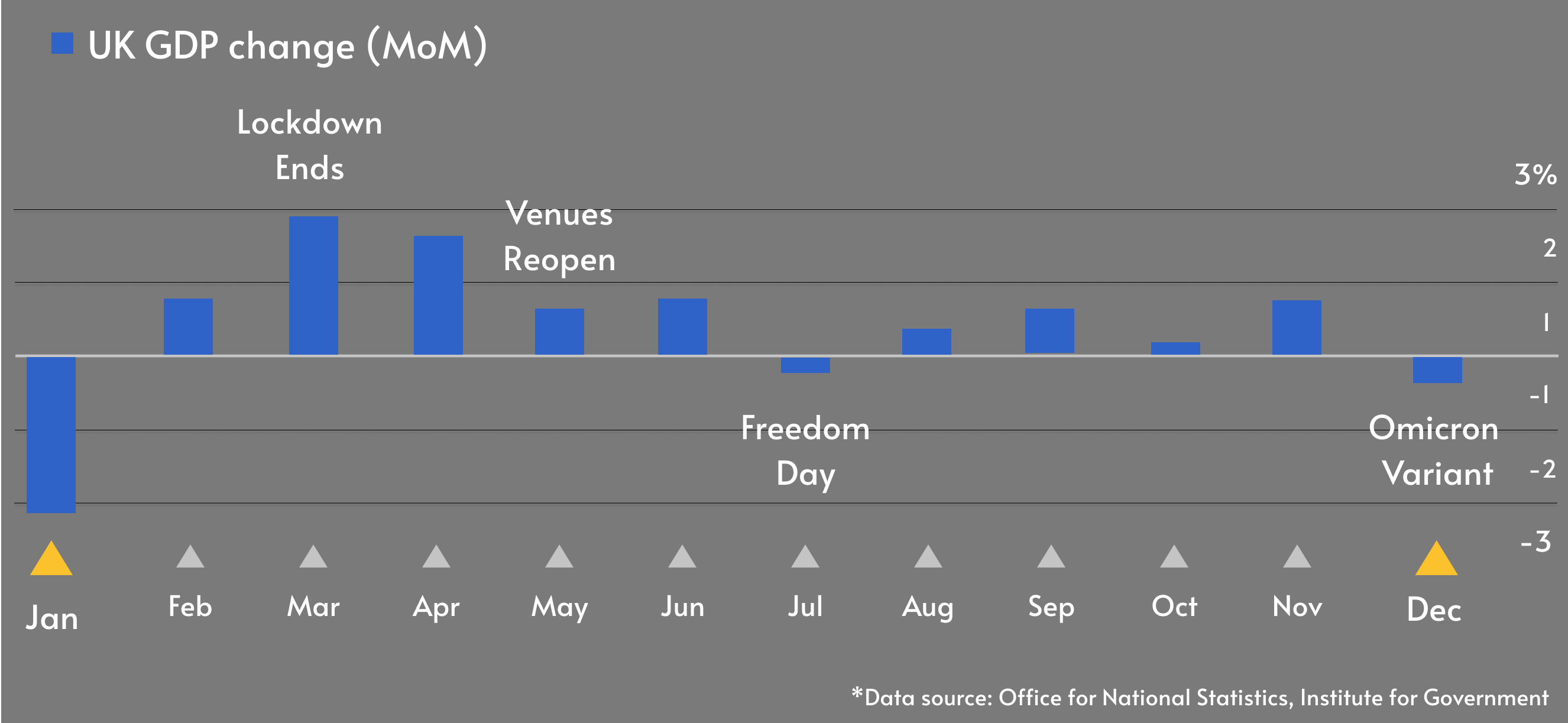

See your funding optionsThe closing months of 2021 saw Britain become the fastest-growing advanced economy in the world with growth not seen for over 80 years. GDP rose by 0.9% from October to November, surpassing pre-pandemic levels by 0.7%. Growing by more than 7% overall, and despite consumer-facing services remaining around 5% below pre-pandemic peak (a factor attributed to the introduction of Omicron restrictions), data marks the period as the country’s fastest expansion since 1941.

The new rules, which Johnson says will help jump start the economy, will see savvy business owners making investment and staffing decisions today based on the PM’s statement. Supporting the trend, Deloitte’s Q4 CFO Survey found a record emphasis on increasing capital expenditure, with high consumer demand, organisational change and rising energy prices expected to drive investment further in 2022.

Covid-19 has had a dramatic impact on nations, economies, businesses and the communities within them. Now, a recent study from Curren Goodden Associates (CGA) has found that 70% of people again feel confident in visiting pubs, bars, and restaurants and are hopeful that they have now seen the last of restrictions. These figures will be welcomed by businesses and consumers alike, who after grappling with a brutal rise in living costs and, almost two years since they first put their lives on hold, will now be more eager than ever to welcome this ‘new normal’.

Apply for fundingSubscribe to our newsletter today

Sign up for the best of Funding Options sent straight to your inbox.