Covid-19

5 business continuity tips for SMEs navigating COVID-19

8 May 2020

As the government begins to draft plans for getting employees back into work, individual businesses are working around the clock to bolster their own business continuity plans. If the health crisis has shown us anything, it’s that we can’t predict the future. But we can take proactive measures that will help us build resilience in the weeks and months to come.

We’ve identified five key business continuity tips to help you keep your business up and running when the lockdown measures are gradually eased.

1. Create a remote working policy

Easing employees back into the working environment may require you to adapt your pre-pandemic business practices to include flexible working. A lot of people will be nervous about commuting and reduced services may lead to delays. Also, some of your employees might enjoy working from home and find themselves just as (if not more) productive doing so.

So, to increase productivity, trust and morale, you should reassess what the new normal might look like with an open mind. Businesses that embrace the future of working will be those that attract top talent and foster a resilient culture.

Tools like Zoom, Slack and Asana are enabling us to collaborate and communicate effectively with our teams when working from home. However, in the long-term, proper planning for remote working is vital and every business should have a remote working policy for employees.

Clear guidelines and expectations around remote working can help set people’s minds at ease. Your policy should include information about working hours, legal rights, cybersecurity requirements and wellbeing.

You’ll find a range of remote work policy templates here.

Things to cover in your policy:

Technology

Ensure your team has everything they need to do their work comfortably. Provide everyone with the necessary software, hardware and tools – from CRM access to computer monitors.

Security

Make sure your team has access to a secure WiFi network and VPN that will encrypt data to protect it from third party interception.

Communication

Remote working can be isolating so it’s important to include communication measures in your policy. How often will you check in with employees in relation to work and wellbeing?

Trust

At the end of the day, you need to trust your employees to get the job done when they’re not in the office. Set clear expectations, try to avoid micromanagement and understand that some people will take longer than others to adjust to the transition.

Your remote working policy should be a work in progress; schedule in time to review and update it at least once a month to begin with and every few months thereafter.

2. Consider a flexible workspace

Many businesses are thinking about replacing their office leases with more flexible workspace arrangements.

Unlike traditional office leases, flexible workspaces enable businesses to operate in a more agile way. While an office lease can last for three years or more, you can rent a flexible workspace for a short-term period and scale up or downsize at short notice.

This is particularly useful for business continuity and recovery in uncertain times, when a business’ workforce might fluctuate significantly from one month to the next.

Flexible workspaces are becoming increasingly popular with businesses of all shapes and sizes and there are lots of options to choose from.

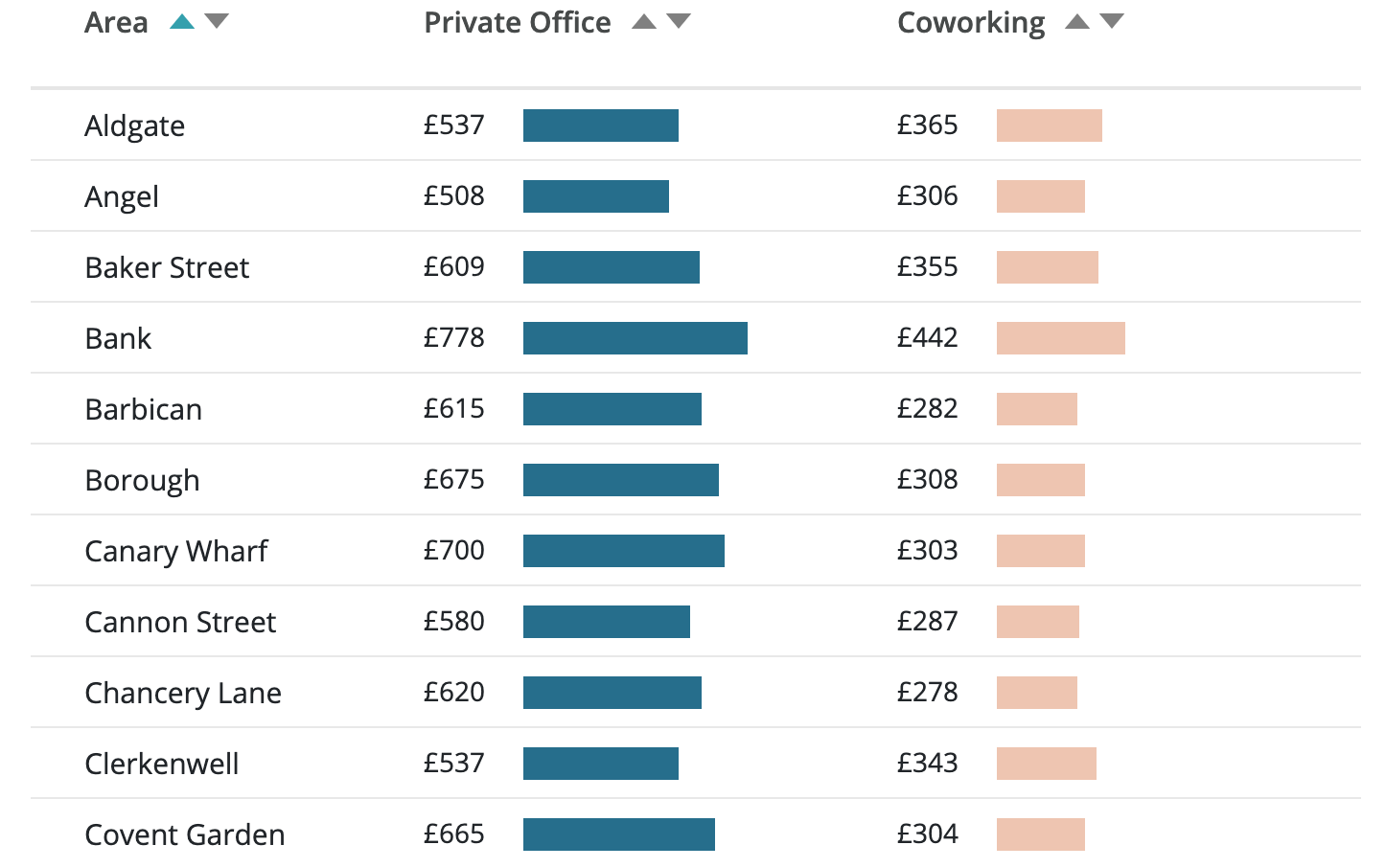

Free Office Finder is an online platform that allows you to search for flexible workspaces in London and the UK. You can use their useful serviced office pricing tool to calculate and compare the average cost per desk in different locations.

Snapshot of office pricing results on 5th May 2020.

3. Prioritise people's safety

The safety and wellbeing of your employees is the number one priority. Your team, as well as your customers and other stakeholders, will be looking to you for guidance during this time.

Be transparent about how you are navigating the COVID-19 crisis and address concerns openly. Together with your remote work policy, draft an employee wellbeing policy that will enable your staff to create a safe and positive environment at home. Similarly, reassure employees that you are doing everything you can to enable physical distancing in the workplace once it reopens. Enhanced antiviral cleaning, 50% occupancy in buildings and plexiglass shields are all measures that are being discussed in lead up to the easing of the lockdown.

Be sure to keep in regular contact with your team and update them on any changes that you’re making in line with governmental guidance.

4. Rethink your strategy

Many businesses are continuing to face significant disruption and a shift in customer demand. This has prompted some to change their approach and others to pivot entirely.

Either way, it’s a good idea to evaluate the different aspects of your business as we emerge from this crisis so that you can pre-empt potential hurdles and mitigate further disruption. Keep a close eye on cash flow, stay in regular contact with suppliers, test financial plans for different scenarios and consider scaling back on non-essential expenses.

Revisit your marketing strategy regularly. How can you support your customers and followers once the lockdown measures are eased? Can you back up any decisions you make with regards to things like re-openings with information from reputable sources such as WHO and gov.co.uk? Although getting your messaging and tone right can sometimes be tricky, avoiding the subject altogether is a no no.

In failing to address the circumstances as they change, you run the risk of coming across as detached. After all, people will expect to hear about how you are keeping your team and customers safe.

5. Utilise financial support measures

Finally, keep up-to-date with the financial support measures that are available to you should you need them. The government has put together an extensive package of measures, including business support grant funds, the Coronavirus Business Interruption Loan Scheme, rates relief, tax deferrals and more.

Due to the unprecedented nature of the pandemic, the measures are subject to change so it’s important to keep one step ahead. You’ll find articles on our blog about the government’s support package and a range of other funding options, including working capital, asset refinance and open banking.

Subscribe to our newsletter today

Sign up for the best of Funding Options sent straight to your inbox.